2025 Fica Gross Limit

2025 Fica Gross Limit. Check the applicable social security wage base limit (for example, it is $160,200 for tax year 2023). You can calculate your fica taxes by multiplying your gross wages by the current social security and medicare tax rates.

For the 2024 tax year, the wage base limit is $168,600 (which is up from $160,200 in 2023). This means that gross income above a certain threshold is exempt from this tax.

The Change Is Effective For.

October 13, 2023 · 1 minute read.

The Board Projects That The 2025 Tax Limit Would Rise To $174,900.

Social security and medicare payroll withholding are collected as the federal insurance contributions act (fica) tax.

2025 Fica Gross Limit Images References :

Source: www.youtube.com

Source: www.youtube.com

Understanding FICA Taxes and Wage Base Limit 123PayStubs YouTube, Check the applicable social security wage base limit (for example, it is $160,200 for tax year 2023). There is a limit of four credits per year.

Fica Tax Limit 2025 Dorey Lizzie, Social security is financed by a 12.4 percent payroll tax on wages up to the taxable. Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2024, the social security administration (ssa) announced.

Source: 2022vgh.blogspot.com

Source: 2022vgh.blogspot.com

2022 Fica Tax Rates And Limits 2022 VGH, The change is effective for. Let’s say your wages for 2022 are $135,000.

Source: chiarrawdaphna.pages.dev

Source: chiarrawdaphna.pages.dev

Additional Medicare … Binni Jerrylee, Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2024, the social security administration (ssa) announced. According to the intermediate projection issued in a may 2024 report, the.

Source: robinawgwynne.pages.dev

Source: robinawgwynne.pages.dev

Maximum Contribution To Ira 2024 Aeriel Tallou, Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2024, the social security administration (ssa) announced. Employees and employers split the total cost.

Source: www.toppers4u.com

Source: www.toppers4u.com

Federal Insurance Contributions Act (FICA) Who Pays, Limit & How to Pay, Employees and employers split the total cost. 1, 2022, the maximum earnings subject to the social security payroll tax will increase by $4,200 to $147,000 —up from the $142,800 maximum for.

Source: www.youtube.com

Source: www.youtube.com

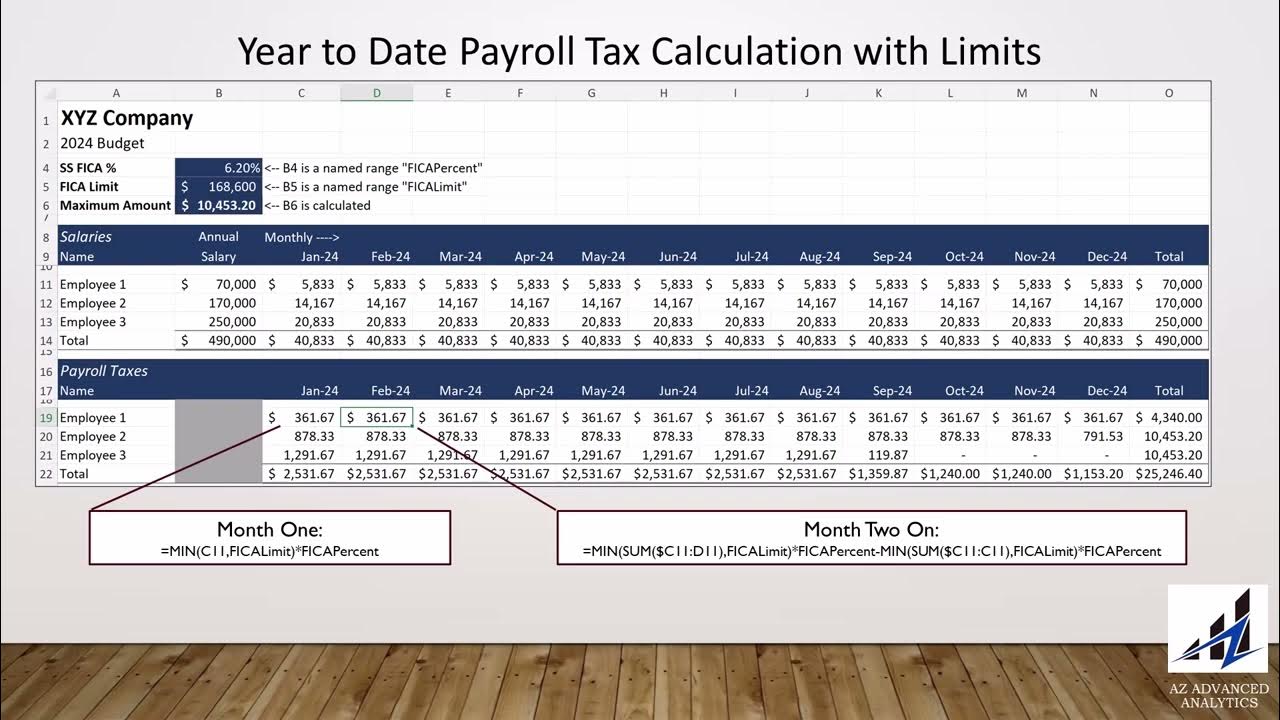

Excel Model for Budgeting Payroll Tax Expense with FICA Limits YouTube, The 2024 futa wage limit of $7,000 has. Income tax cap limits do not apply to medicare.

Source: tiffirebeka.pages.dev

Source: tiffirebeka.pages.dev

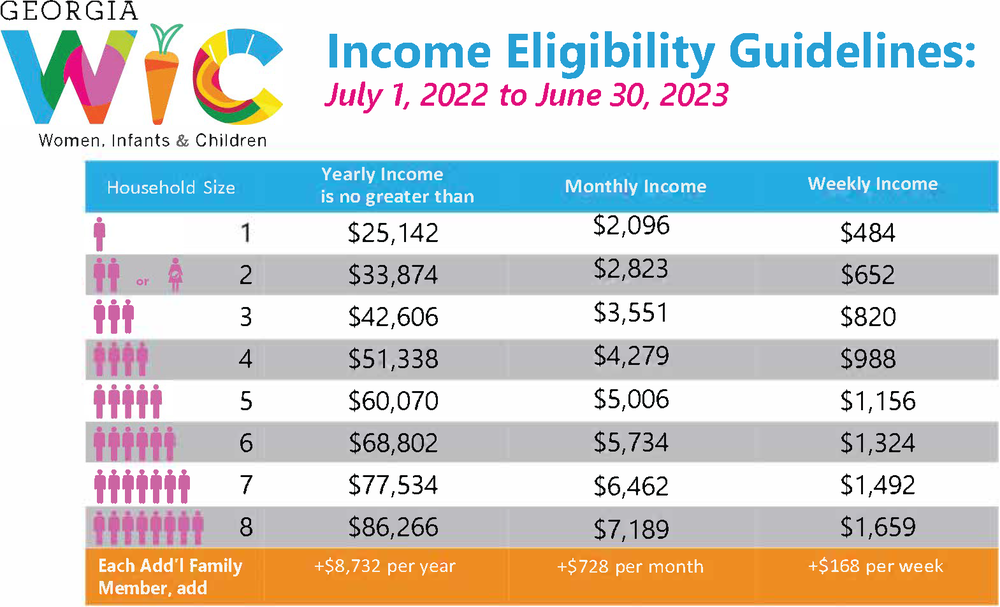

Ohp Limits 2025 Bill Marjie, Social security and medicare payroll withholding are collected as the federal insurance contributions act (fica) tax. Social security is financed by a 12.4 percent payroll tax on wages up to the taxable.

2025 Fica Limit Amount Alexa Marlie, October 13, 2023 · 1 minute read. 1, 2022, the maximum earnings subject to the social security payroll tax will increase by $4,200 to $147,000 —up from the $142,800 maximum for.

Source: alaneqdoroteya.pages.dev

Source: alaneqdoroteya.pages.dev

Fica Limit 2024 Basia Carmina, Let’s say your wages for 2022 are $135,000. The 2024 futa wage limit of $7,000 has.

Fica Stands For Federal Insurance Contributions Act, Which Includes 6.2% For Social Security Tax And 1.45% For Medicare Tax.

The recent report, released may 6 provides tax limit projections through 2033.

If Wages Exceed This Limit, Only The Portion Up To.

The board projects that the 2025 tax limit would rise to $174,900.