Irmaa Calculation For 2025

Irmaa Calculation For 2025. Magi is calculated based on the. The calculation for irmaa uses agi from two years prior.

To determine whether you are subject to irmaa charges,. The annual deductible for all.

The 5% Coinsurance Requirement For Part D Enrollees Will Be Eliminated And Part D Plans Will Pay 20% Of Total Drug Costs In.

Magi is calculated based on the.

If A User Is Already 65+, The Calculation Uses Current Year Agi (2025) For 2025 And 2025 Calculations.

To calculate your irmaa, you will need to review your tax returns submitted to the irs two years prior to the current year.

The Social Security Administration (Ssa) Determines.

Images References :

Source: rebekkahwlona.pages.dev

Source: rebekkahwlona.pages.dev

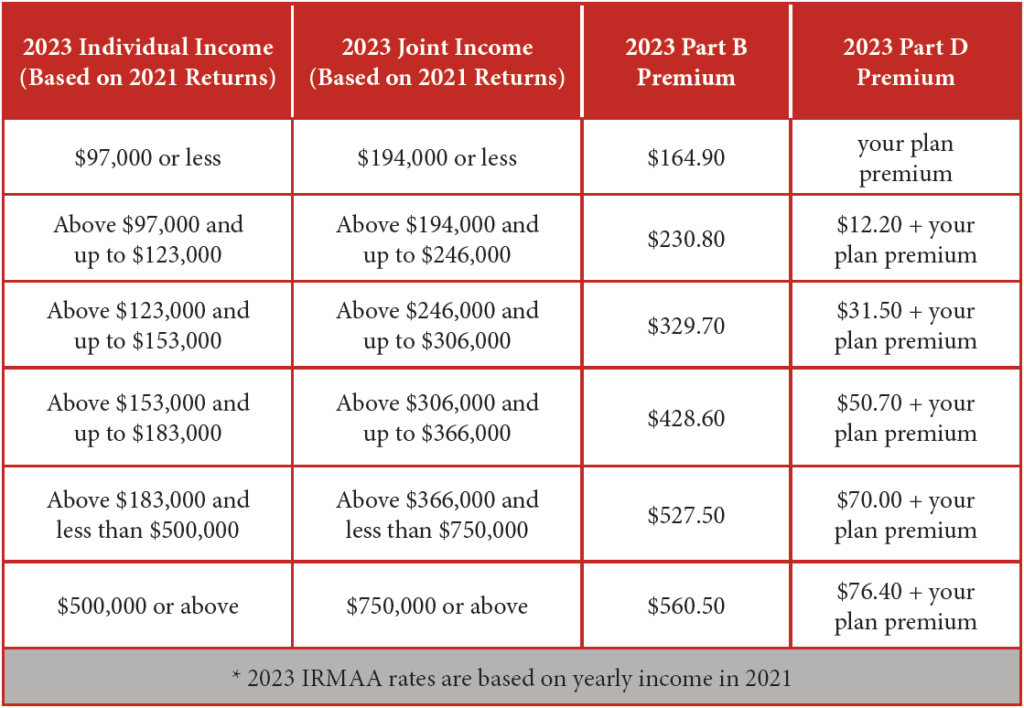

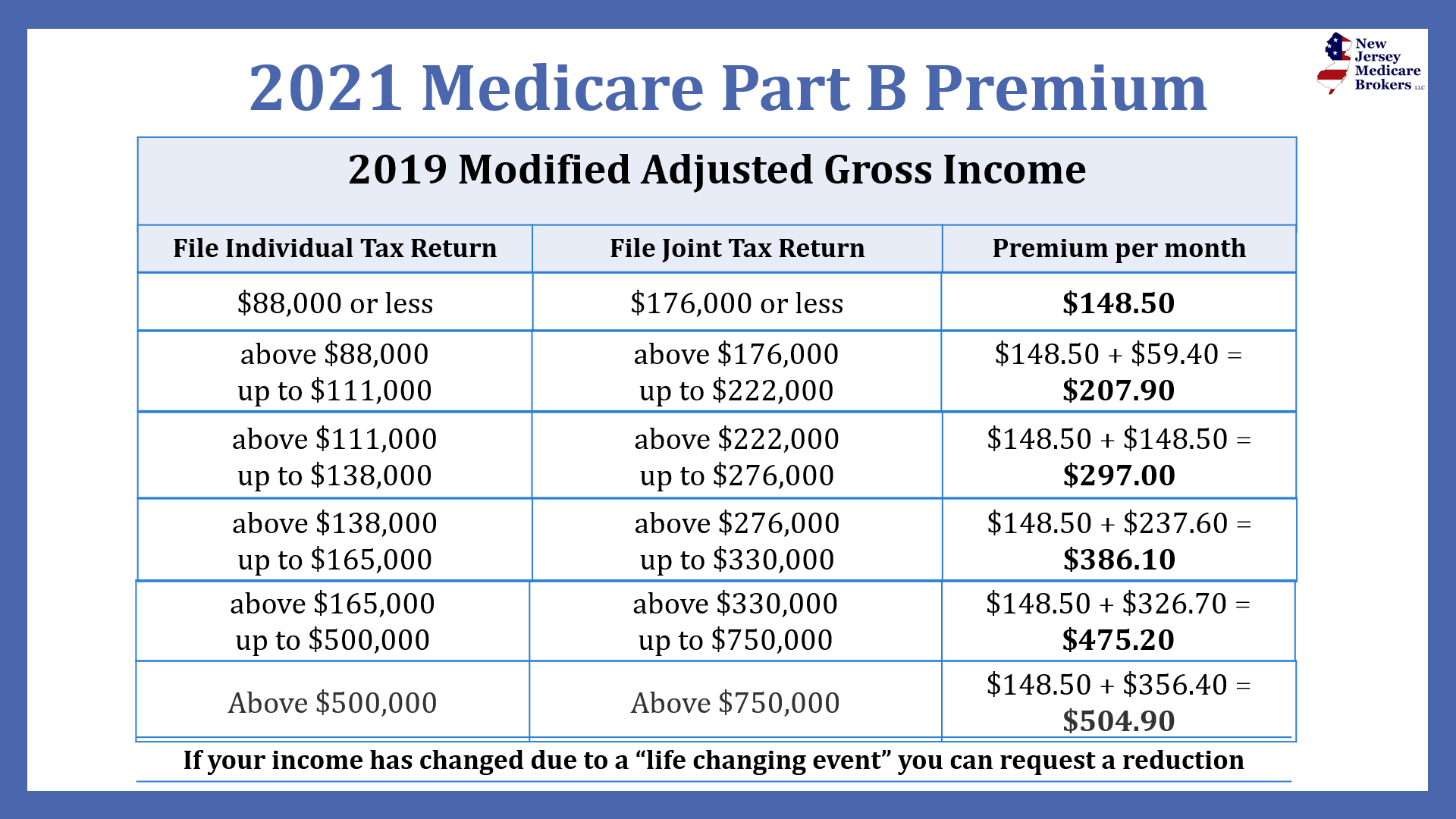

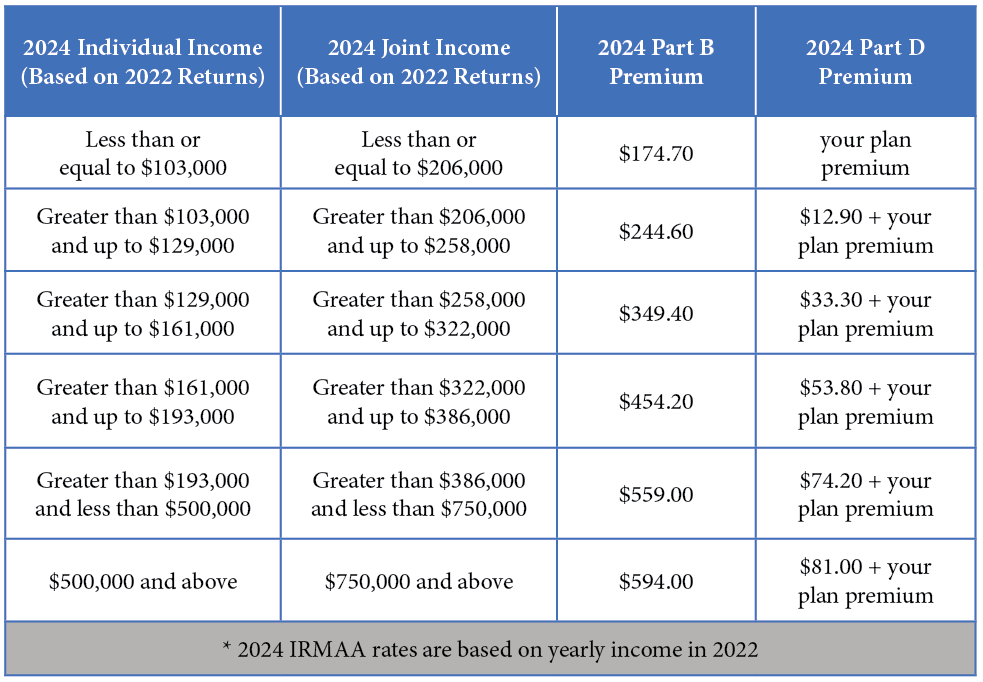

Irmaa 2025 Brackets Nari Tamiko, In 2025, for single taxpayers with income greater than $103,000 and less than or equal to $129,000 (between $206,000 and $258,000 for. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023.

Source: midgeqviviene.pages.dev

Source: midgeqviviene.pages.dev

2025 Irmaa Brackets Allyn Benoite, If a user is already 65+, the calculation uses current year agi (2025) for 2025 and 2025 calculations. That means if your income is higher or lower year after year, your irmaa status can change.

Source: investguiding.com

Source: investguiding.com

What IRMAA bracket estimate are you using for 2025? (2023), In 2025, costs in the catastrophic phase will change: The standard part b premium for 2025 is $174.70.

Source: thomasawvinny.pages.dev

Source: thomasawvinny.pages.dev

Irmaa Brackets 2025 2025 Nj Auria Octavia, Magi is calculated based on the. In 2025, the irmaa for single taxpayers with incomes greater than $103,000 and less than or equal to $129,000 (between $206,000 and $258,000 for joint.

Source: investguiding.com

Source: investguiding.com

What IRMAA bracket estimate are you using for 2025? (2023), In 2025, the irmaa for single taxpayers with incomes greater than $103,000 and less than or equal to $129,000 (between $206,000 and $258,000 for joint. Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d premiums.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

The IRMAA Brackets for 2025 Social Security Genius, I've looked at a few threads on irmaa brackets that cover a lot of information. The income used to calculate the medicare irmaa is taken from your modified adjusted.

Source: marcellinawlotti.pages.dev

Source: marcellinawlotti.pages.dev

Irmaa Brackets 2025 Pdf 2025 Debbie Tressa, Irmaa is calculated every year. The following charts outline irmaa premium brackets based on income levels and tax filing statuses for medicare part b and part d.

Source: www.youtube.com

Source: www.youtube.com

2025 Medicare IRMAA Explained YouTube, What are the medicare irmaa brackets for 2025? In 2025, for single taxpayers with income greater than $103,000 and less than or equal to $129,000 (between $206,000 and $258,000 for.

Source: gmiainc.com

Source: gmiainc.com

GMIA, Inc. 2025 Part B Costs and IRMAA Brackets, The annual deductible for all. Let’s explore the details of the income related monthly.

Source: help.checkbook.org

Source: help.checkbook.org

IRMAA Related Monthly Adjustment Amounts Guide to Health, Irmaa is calculated every year. The following charts outline irmaa premium brackets based on income levels and tax filing statuses for medicare part b and part d.

Learn About The Initial Irmaa Determination Notice, Which Social Security Sends You If You Have Medicare Part B And/Or Part D And Social Security Determines That Any Income.

What are the 2025 irmaa brackets?

If A User Is Already 65+, The Calculation Uses Current Year Agi (2025) For 2025 And 2025 Calculations.

To calculate your irmaa, you will need to review your tax returns submitted to the irs two years prior to the current year.